AI-Created Crypto Portfolio for the Altseason Bull Market

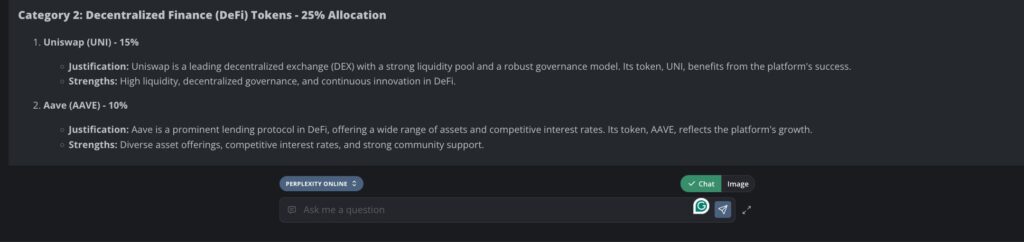

The AI-Created Crypto Portfolio for the Altseason Bull Market is a strategically designed investment plan aimed at capitalizing on the anticipated growth in the cryptocurrency market. Developed using Perplexity Online, a leading AI model, the portfolio features a diversified selection of cryptocurrencies across four key categories: Layer 1 blockchains (50% allocation), DeFi tokens (25%), infrastructure solutions (15%), and emerging technologies (10%). Notable inclusions are Ethereum, Solana, Uniswap, and Chainlink, all chosen for their strong fundamentals and growth potential. This portfolio serves as a guide for investors looking to optimize their returns during the upcoming altseason while emphasizing the importance of conducting personal research before making investment decisions.

As the cryptocurrency bull market gains momentum, with over $465 billion added to market capitalization in just five days, Finbold consulted a leading artificial intelligence (AI) to curate a crypto portfolio tailored for the anticipated altseason.

The AI model utilized was Perplexity Online, recognized as a top competitor to ChatGPT due to its ability to scan the web in real-time for the latest information. This feature is essential for constructing a successful crypto portfolio for 2024 and 2025.

Perplexity AI crafted a diversified portfolio across four categories of cryptocurrencies, focusing on solid altcoins poised for growth during the bull market. The first category accounts for 50% of the total allocation, divided among three tokens, while the remaining categories each contain two projects.

Portfolio Overview

“The portfolio emphasizes projects with strong fundamentals, utility, and technological innovation. Layer 1 blockchains such as Ethereum, Solana, and Cardano provide a robust foundation. DeFi tokens like Uniswap and Aave tap into the expanding DeFi ecosystem, while infrastructure projects like Polkadot and MultiversX address scalability and interoperability challenges. Additionally, Chainlink and The Graph are critical for dApps and DeFi, enhancing the overall ecosystem.”

— Perplexity Online AI

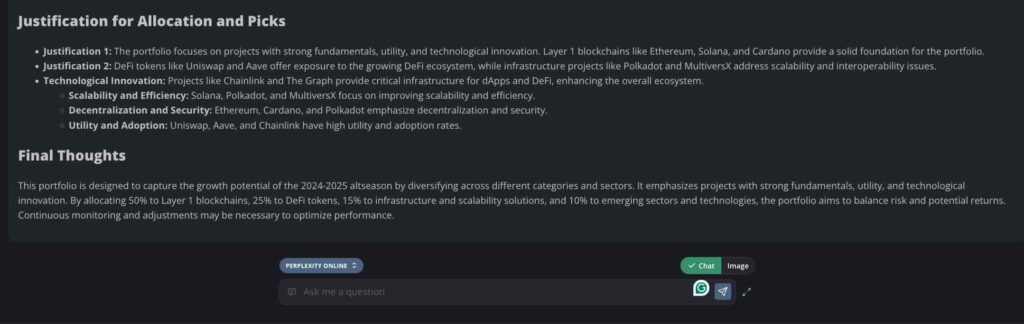

Layer 1 Blockchains (50% Allocation)

The AI allocated 50% of the portfolio to Layer 1 blockchains, with Ethereum (ETH) receiving 25%, Solana (SOL) 15%, and Cardano (ADA) 10%.

- Ethereum: The leading altcoin and smart contract platform, underpinning a vast ecosystem of decentralized applications.

- Solana: Known for its rapid transaction speeds and low fees, making it appealing to users.

- Cardano: Recognized for its rigorous approach to blockchain development, establishing a strong foundation.

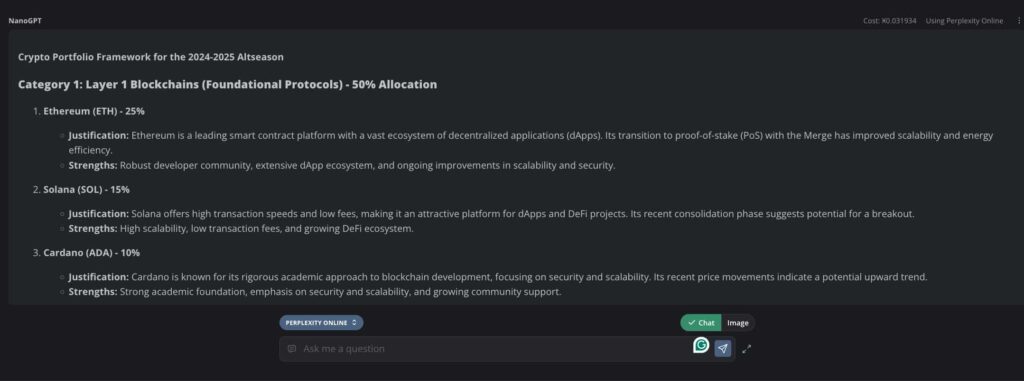

Decentralized Finance (DeFi) Tokens (25% Allocation)

The second category focuses on DeFi tokens, with a total allocation of 25%. The AI selected Uniswap (UNI) and Aave (AAVE), allocating 15% and 10%, respectively. Both are leaders in the decentralized exchange and lending protocol spaces.

Infrastructure and Scalability Solutions (15% Allocation)

For infrastructure and scalability, the AI allocated 15% to mid-cap altcoins. Polkadot (DOT) received 10%, while MultiversX (EGLD) got 5%.

- Polkadot: Focuses on multi-chain interoperability.

- MultiversX: Aims for high scalability and security, addressing modularity with sovereign chains.

Emerging Sectors and Technologies (10% Allocation)

The final 10% of the portfolio is dedicated to emerging sectors and technologies, with Chainlink (LINK) and The Graph (GRT) each receiving 5%.

“This portfolio is structured to leverage the growth potential of the 2024-2025 altseason by diversifying across various categories and sectors. It prioritizes projects with robust fundamentals, utility, and technological innovation, aiming to balance risk and potential returns. Regular monitoring and adjustments will be essential for optimizing performance.”

— Perplexity Online AI

While Perplexity AI is adept at gathering and analyzing real-time data, it's crucial for investors to verify all information and conduct their own research before making financial decisions. Building a resilient

FAQ: AI-Created Crypto Portfolio for the Altseason Bull Market

Q1: What is the purpose of the AI-created crypto portfolio?

A1: The AI-created crypto portfolio is designed to help investors capitalize on the anticipated altseason bull market by selecting a diversified range of cryptocurrencies that are expected to perform well based on strong fundamentals and market trends.

Q2: How was the portfolio constructed?

A2: The portfolio was constructed using Perplexity Online, an AI model that scans the web for real-time information. It analyzes various cryptocurrencies and allocates funds based on their potential for growth during the bull market.

Q3: What categories are included in the portfolio?

A3: The portfolio is divided into four categories:

- Layer 1 Blockchains (50% allocation)

- Decentralized Finance (DeFi) Tokens (25% allocation)

- Infrastructure and Scalability Solutions (15% allocation)

- Emerging Sectors and Technologies (10% allocation)

Q4: Which cryptocurrencies are included in the Layer 1 Blockchains category?

A4: The Layer 1 Blockchains category includes:

- Ethereum (ETH) - 25%

- Solana (SOL) - 15%

- Cardano (ADA) - 10%

Q5: What DeFi tokens are part of the portfolio?

A5: The DeFi Tokens category includes:

- Uniswap (UNI) - 15%

- Aave (AAVE) - 10%

Q6: Which projects are considered for Infrastructure and Scalability Solutions?

A6: The Infrastructure and Scalability Solutions category features:

- Polkadot (DOT) - 10%

- MultiversX (EGLD) - 5%

Q7: What cryptocurrencies are included in the Emerging Sectors and Technologies category?

A7: This category includes:

- Chainlink (LINK) - 5%

- The Graph (GRT) - 5%

Q8: What is the overall strategy of the portfolio?

A8: The portfolio aims to leverage the growth potential of the altseason by diversifying investments across various categories and sectors. It prioritizes projects with strong fundamentals, utility, and technological innovation to balance risk and potential returns.

Q9: Should investors rely solely on the AI's recommendations?

A9: While the AI provides valuable insights and recommendations, it is crucial for investors to conduct their own research and verify information before making any financial decisions. Market conditions can change rapidly, and personal due diligence is essential.

Q10: How often should the portfolio be monitored?

A10: Regular monitoring is recommended to assess performance and make necessary adjustments based on market trends, developments in the cryptocurrency space, and changes in individual project fundamentals.

What's Your Reaction?